Executive Summary

The long-term viability of Orca DAO demands disciplined operational interdependence, shifting the focus from speculative transactions to fiduciary rigor.

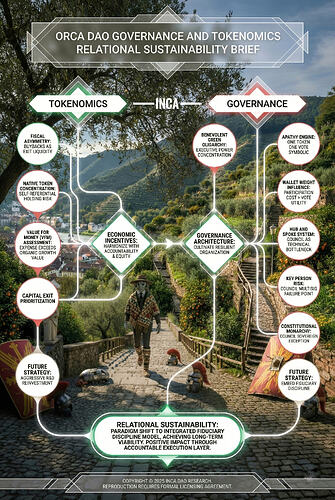

The INCA DAO research brief identifies Orca as a Benevolent Green Oligarchy, concentrating executive power within the Orca Governance Council while utilizing the ethical mandate of the Climate Fund to justify centralized authority.

The health of the protocol depends on addressing the significant divergence between marketed democratic goals and the operative functional reality.

Governance: The Power Apathy Loop

The governance system remains critically centralized, creating a persistent Apathy Engine. The top ten wallet addresses command approximately 60 percent of the circulating supply, ensuring the One Token One Vote mechanism is largely symbolic.

The structural allocation means that the Cost of Participation for the average token holder exceeds the expected utility of their vote. Proposals, frequently pass with minimal community engagement, confirming that influence is primarily restricted by Wallet Weight, not verifiable contribution.

The governance model operates as a Hub and Spoke system. The Council acts as the indispensable hub, holding the necessary technical capacity for execution. This bottleneck ensures that any significant protocol change requires the Council’s direct involvement.

On the meritocratic front, the DAO prioritizes asset-based authority over contribution-based reputation. Beyond simple delegation, there’s not embedded systems to incentivize long-term, cumulative, non-monetary qualitative labor.

Legal Frameworks and Security Posture

The DAO functions largely as an Unincorporated Association, a structure that potentially exposes active voting members to joint liability. The governance layer effectively serves as a Human Shield, socializing the regulatory risk of the core software product onto the community.

Operational security is subject to existential Key Person Risk. The group managing the Council multisig simultaneous departure, hacking or incapacitation constitutes the Single Point of Failure for treasury disbursements and emergency protocol functions.

The team ability to override standard governance timelines classifies the DAO as a Constitutional Monarchy, where the Council retains a sovereign exception to rule by decree.

Tokenomics: The Fiscal Tribute

The financial architecture displays persistent Fiscal Asymmetry. The utilization of treasury funds for token buybacks, while presented as value accrual, primarily enable Exit Liquidity for early stakeholders. This mechanism prioritizes minimum volume over aggressive reinvestment in Research and Development.

Furthermore, the treasury maintains a high concentration of native token. This self-referential holding creates a structural risk to operational continuity, as a price decline severely limits the DAO’s financial maneuverability. A Value for Money (VfM) Assessment indicates that the expense of maintaining the Council and grants programs often exceeds the measurable value returned in organic protocol growth.

Conclusion: Relational Sustainability

Compared to its peer group, Orca demonstrates strong technical product performance but fragile governance architecture.

The future trajectory demands shifting the paradigm from reliance on a benevolent council to an integrated model embedding fiduciary discipline within the protocol’s execution layer.

For community members and stakeholders new to relational frameworks, sustainability is achieved by cultivating a resilient organization where economic incentives harmonize with accountability and equity.

© INCA DAO Research 2025. Reproduction is reserved for formal licensing engagements.